"If you have the feeling that you are experiencing economic whiplash, you are certainly not alone. The last two years have quite literally dumped every conceivable economic issue on business and in an intense and often unpredictable manner," begins June's Industrial Heating Equipment Association’s (IHEA) Executive Economic Summary. Because conditions are changing so quickly, it's been difficult for businesses to develop strategic plans.

The report explains, "In 2020 the world experienced a massively deep recession whose origins were truly unique – a recession by edict. That has been followed by a surging recovery that shattered the ability of the system to keep pace. This has led to severe shortages and very high inflation in a number of sectors." So, here we are in mid-2021 and the result is a two-tiered economy in which you have businesses recording high demand for their services and other businesses that have yet to experience needed recovery. Some consumers have money to burn, while others are declaring bankruptcy. And, inflation seems to the top issue for the business community. (Read the informative and well-written analysis about inflation in the full report. See below.)

Let's take a look at a few of the indices and how they are trending:

"The auto sector has been hammered harder than most by the supply chain disruptions and that has affected performance considerably. The sales numbers are down as low as they have been in months, but as near as anyone can determine this has nothing to do with consumer demand and everything to do with supply. The average price of a car is as high as it has ever been and is now over $40,000," states the summary. High prices, however, aren't deterring people from wanting to buy vehicles--the demand for cars is real. It's that the automotive industry, ". . . can’t get them as the parts shortages just keep dragging on and on. It is now estimated that computer chips will not be available in the quantities needed until well into 2022." And here's an interesting fact, "The average age of a vehicle in the U.S. is now over 12 years and that is a record."

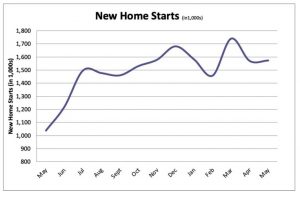

New home starts are up. The report says, "The housing sector is still far stronger than many had expected it to be given the high prices for homes. The demand is there as long as the mortgage rates are not rising and thus far, they have not. In fact, they have even fallen again. The higher end homes are in more demand than the lower end as these less expensive homes are the target for those who have been affected by the recession."

Steel consumption has also risen. "The levels of steel consumption continue to climb – somewhat erratically but they are climbing. This is a bit odd given what has been taking place in the sectors that consume the majority of steel in the U.S.--those sectors like automotive, commercial construction and the uncertain future of office buildings." Why the demand for steel? The report continues, "The biggest motivator has been some version of stockpiling as many are expecting even higher prices in the future and are trying to get ahead of that hike. Then there has been demand for appliances and other goods as housing continues to see growth. Beyond the auto sector, there has been better demand in other transportation sectors as well as in construction and heavy machinery.

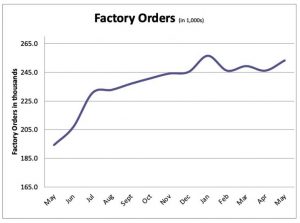

And finally, factory orders are up. "The level of factory orders has started to advance and the timing for these gains is about what was expected. This is the time of year that retailers start to gear up for the holiday season and by all accounts they are expecting a better than average season. The consumer is still in a spending mood and still has cash available to spend."

We're all on this wild economic roller coaster ride together, so hold on tight! It's quite the adventure!

Check out the full report to see specific index growth and analysis which is available to IHEA member companies. For membership information, and a full copy of the 12-page report, contact Anne Goyer, executive director of the Industrial Heating Equipment Association (IHEA). Email Anne by clicking here.