Heat Treat Economic Indicators: April 2024 Results

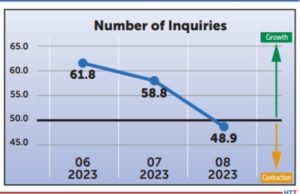

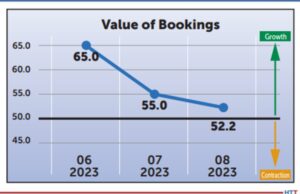

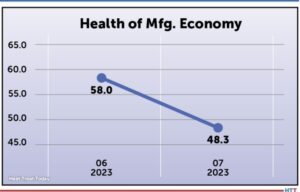

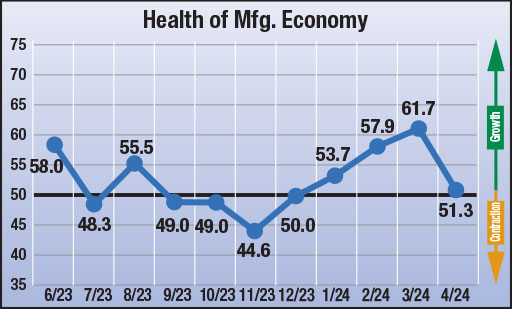

There are four heat treat industry-specific economic indicators gathered by Heat Treat Today each month since June 2023, and this month, we are seeing a marked downturn in expectations across all indicators.

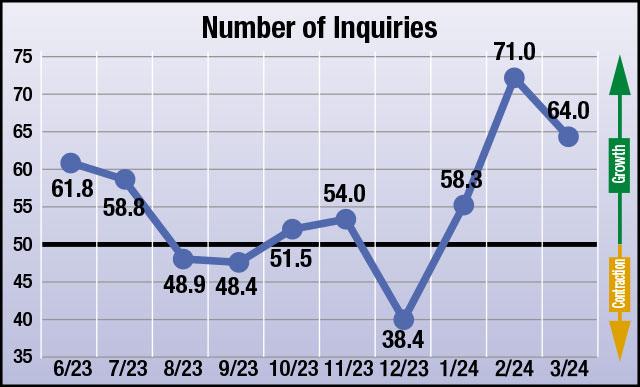

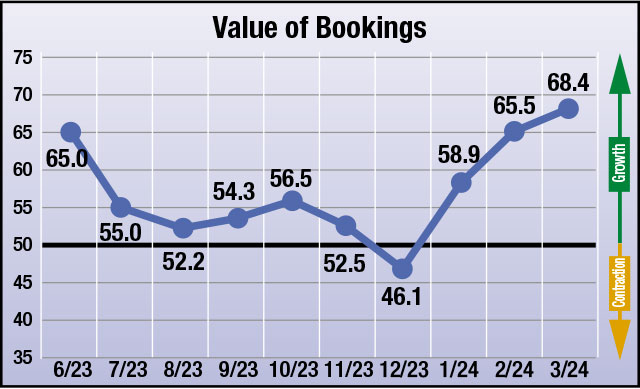

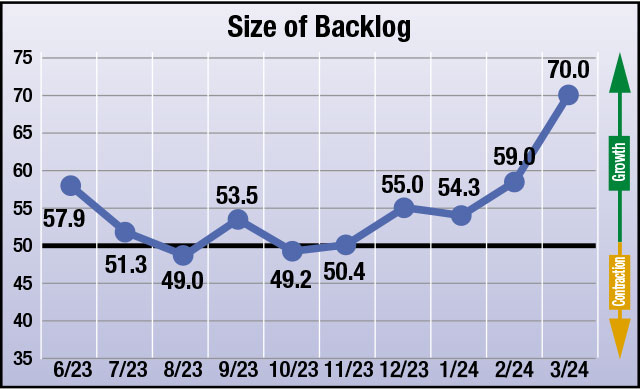

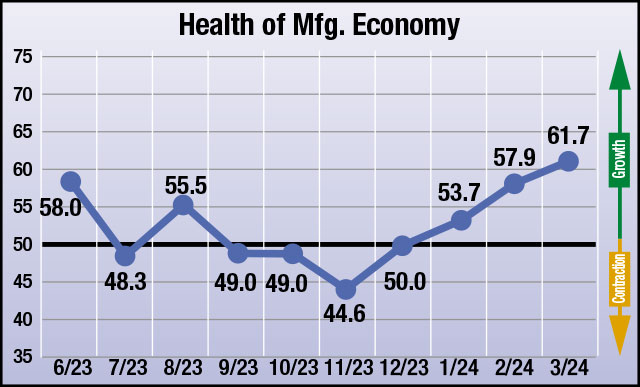

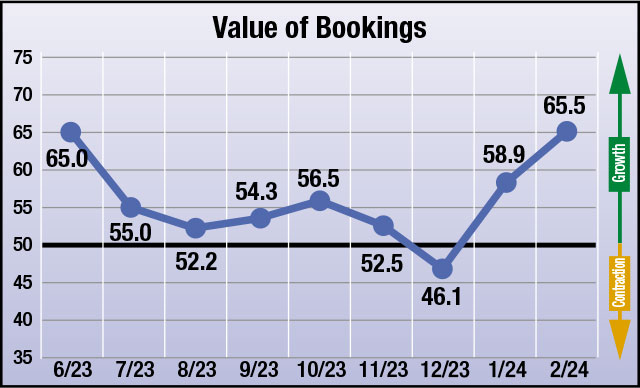

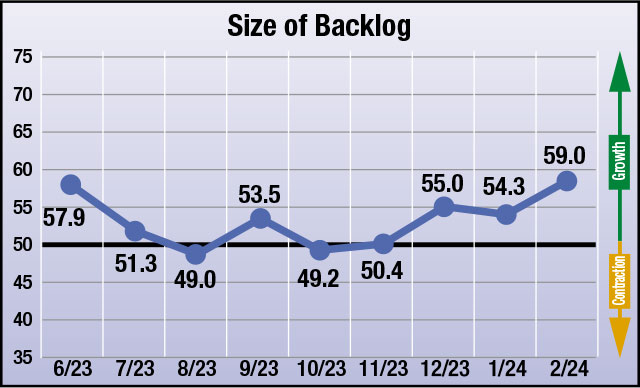

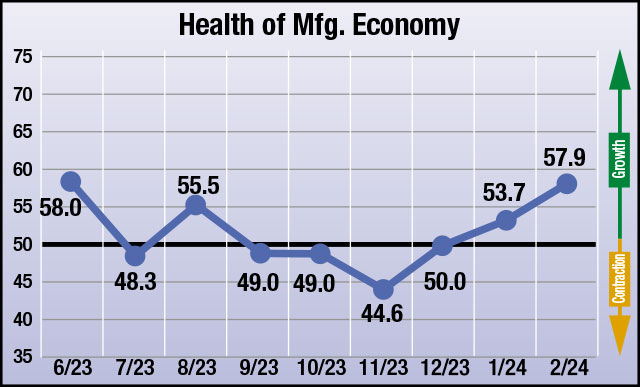

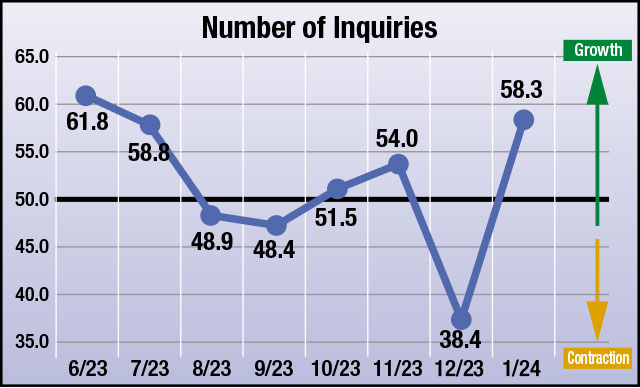

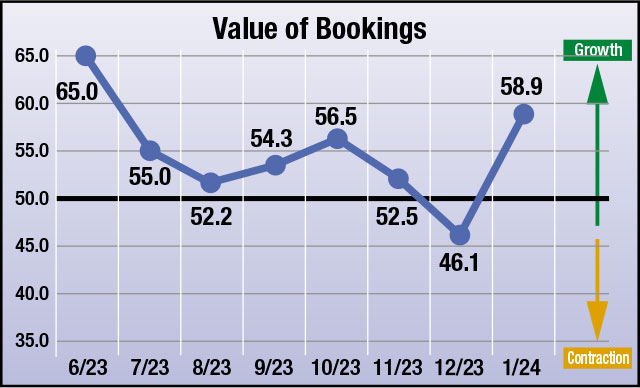

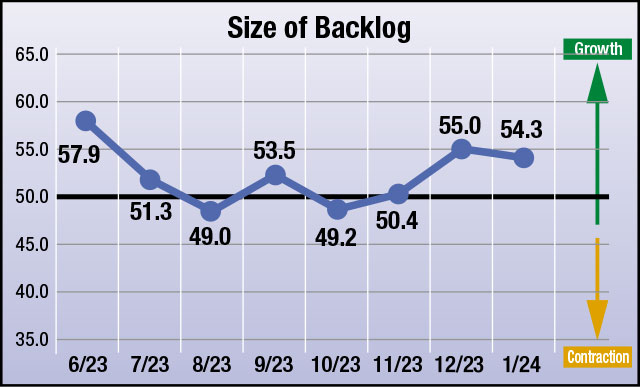

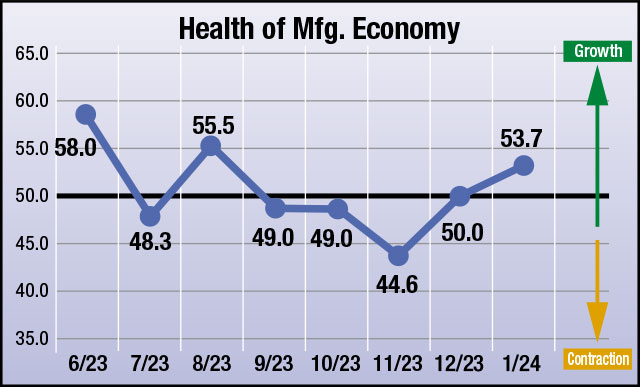

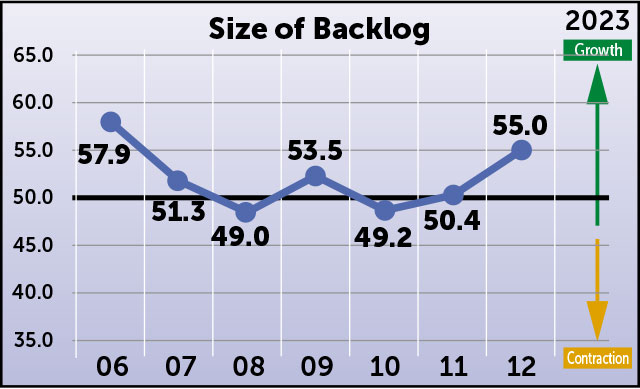

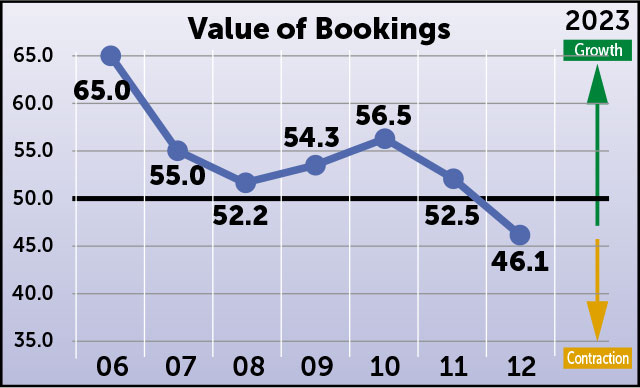

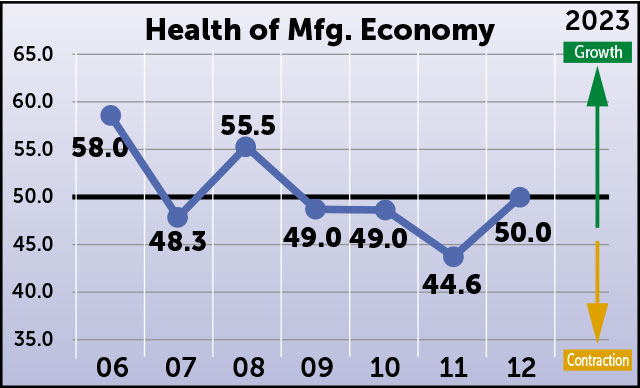

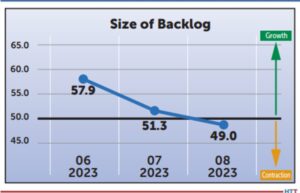

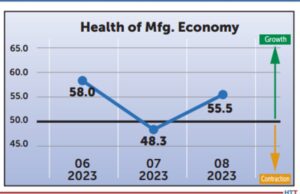

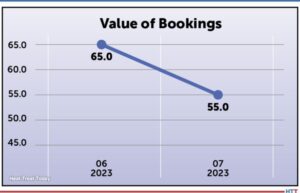

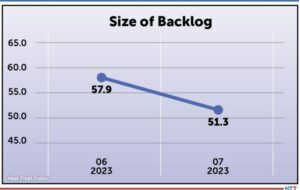

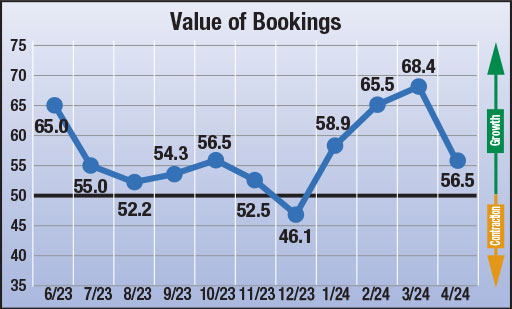

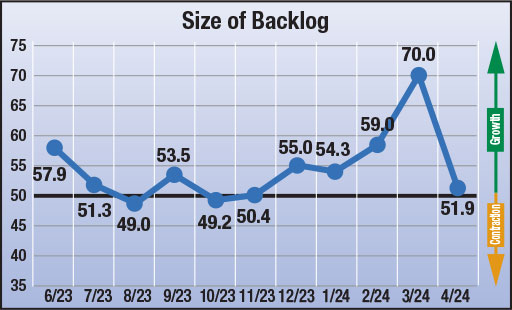

The numbers, compiled in the second week of April, show that responding parties strongly anticipate all four indices — number of inquiry, value of bookings, size of backlogs, and health of manufacturing economy — to grow. However, all projections are significantly down, which would seem to indicate that industry suppliers are approaching April with far more conservative expectations as compared to Q1 2024.

The results from this month’s survey (April) are as follows; numbers above 50 indicate growth, numbers below 50 indicate contraction, and the number 50 indicates no change:

- Anticipated change in the Number of Inquiries from March to April: 51.9

- Anticipated change in Value of Bookings from March to April: 56.5

- Anticipated change in Backlog Size from March to April: 51.9

- Anticipated change in the Health of the Manufacturing Economy from March to April: 51.3

Data for April 2024

The four index numbers are reported monthly by Heat Treat Today and made available on the website.

Heat Treat Today's Economic Indicators measure and report on four, heat treat industry indices. Each month, approximately 800 individuals who classify themselves as suppliers to the North American heat treat industry receive the survey. Above are the results. Data started being collected in June 2023. If you would like to participate in the monthly survey, please click here to subscribe.

Find heat treating products and services when you search on HeatTreatBuyersGuide.com

Heat Treat Economic Indicators: April 2024 Results Read More »