A monthly report issued to member companies of the Industrial Heating Equipment Association (IHEA) reported recently that there “are some important trends that point to a better end to the year.” The report states that one of the main contributing factors is the fact that “exports are surging again.”

Compiled and published monthly by IHEA, this report covers market developments with specific impacts on the thermal processing industry. The report, prepared in cooperation with Armada Corporate Intelligence, analyzes:

- automotive and light truck markets,

- new home starts,

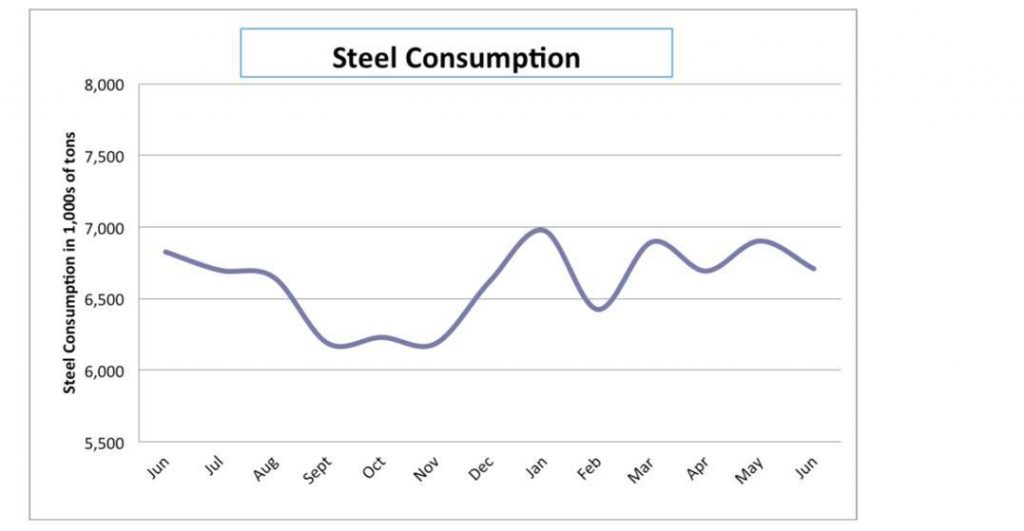

- steel consumption,

- industrial capacity utilization,

- metal prices,

- new orders from PMI,

- capital expenditures,

- durable goods,

- factory orders,

- and others.

While seven of the eleven indices tracked were trending positive in this month’s report, for the steel market the IHEA report states, “The latest trends as far as steel consumption is concerned are not all that favorable and there will be considerable disruption politically as the details of the steel tariff are developed. The two largest components of steel consumption have always been construction (mostly commercial and public sector) as well as the automotive sector. The news is not all that inspiring on either front. The commercial side of construction has been holding its own, especially as far as medical projects are concerned, but office space has been dwindling as there has not been the demand there used to be. The number of people telecommuting has affected the need for big offices. The public sector is still in the doldrums as there is simply no money for the kinds of projects that once drove steel demand. The auto sector had been booming but that has also shown signs of reversal. The demand for new cars is off from the peaks of a few years ago and the only thing that has saved steel demand is that the vehicles that people are buying are larger (trucks and SUVs).

“On top of this, there is the issue of steel tariffs. It is obvious at this point that a blanket 40% tariff will not be imposed as many of the countries that supply steel to the US are close allies (Canada, South Korea, Japan etc.). The end of June deadline came and went and so did the end of July and now the thinking is that a decision may not come until late this year. The fact is that steel users are deeply concerned about price hikes and there are far more of them than there are domestic steel producers. The end result is unclear as China is the target but they only account for about 6% of the steel imported into the US (Canada alone accounts for about 17%).”

For more information about this report contact IHEA directly at anne@goyermgt.com or click here to join IHEA and begin receiving the entire report every month.