Do you remember, or have you ever heard of the comedy duo of Abbot and Costello of the 1940s and early 1950s? One of their most popular skits is “Who’s on First?” which is hilarious, but its title, theme, and overall performance are apt reflections of the questions, frustrations, and confusing answers we are experiencing on a daily basis as we continue to navigate through uncharted waters. September’s Industrial Heating Equipment Association’s (IHEA) Executive Economic Summary begins with questions we’d all like to know the answers to about the future of the economy/recovery and ends with continued hope. “There will soon be a debate as to what to call the period we are entering. Is this the post-pandemic recovery? Is it the second wave pandemic era? Is this the beginning of the ‘blue wave’ or the start of the purple revenge? Is this the end of the beginning or the beginning of the end? At this point a case could be made for any of these.”

Do you remember, or have you ever heard of the comedy duo of Abbot and Costello of the 1940s and early 1950s? One of their most popular skits is “Who’s on First?” which is hilarious, but its title, theme, and overall performance are apt reflections of the questions, frustrations, and confusing answers we are experiencing on a daily basis as we continue to navigate through uncharted waters. September’s Industrial Heating Equipment Association’s (IHEA) Executive Economic Summary begins with questions we’d all like to know the answers to about the future of the economy/recovery and ends with continued hope. “There will soon be a debate as to what to call the period we are entering. Is this the post-pandemic recovery? Is it the second wave pandemic era? Is this the beginning of the ‘blue wave’ or the start of the purple revenge? Is this the end of the beginning or the beginning of the end? At this point a case could be made for any of these.”

It’s always good to look at the data of the indices to get a pulse of what’s happening. Of the 11 indices, five are trending in the positive direction and six are trending negative, however, the report states that “the shifts have been subtle and it is hard to say whether the future trends will continue to follow the current pattern.”

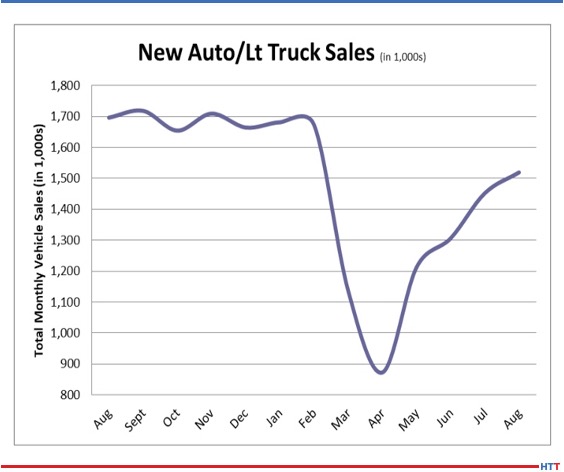

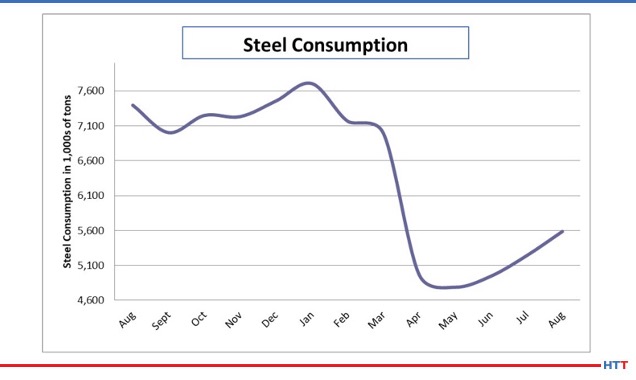

The report continues, “In many respects the economy now seems in better shape than it was just a few months ago and far better than many had expected at this point. That is reflected in the indicators that showed improvement this month.” The gains were in the new automobile/light truck sales, steel consumption, industrial capacity utilization, metal prices, and factory orders.

New home starts, capital expenditure, PMI new orders, credit, durable goods and transportation experienced a decline last month, however, in “many of these readings the changes from last month were minor and the numbers remain far stronger than they were even as recently as July and August. The economy is changing and that has meant decline for some and progress for others.”

While the upcoming election may bring changes, the summary states, “The reality is that the focus of the next year will be the same regardless of who wins the White House and/or Congress. The pandemic may dominate the economy as it has through 2020.” The projections for 2021 fall into two categories. The first scenario is one in which “the recovery will start picking up speed as this year ends and will continue to gain traction into the first half of next year before slowing down slightly.” The second scenario is the more cautious assumption based on an expected spread of the virus through the colder months. The good news is that in both scenarios the end of 2021 will see growth numbers that will look a lot like the numbers at the start of 2020.

Finally, given all the uncertainty, what should be on the watch list for business and manufacturers specifically? The summary concludes, “The key factors to watch will be those that reflect month to month changes and that will include the Purchasing Managers’ Index as well as the Credit Managers’ Index. Both look pretty solid right now but have shown some signs of concern as the growth spurt in the PMI has faded and the CMI is starting to show issues with the unfavorable factors. Two other indices to focus on will be capital expenditure and capacity utilization. If the manufacturers are worried about the future, they will be reducing their levels of capital investment (both in terms of machine purchasing as well as physical plant).” The only other early warning sign to look for is in transportation. Parcel activity is going to grow as the holiday spending season ramps up, which means paying closer attention to rail and truck volumes.

Check out the full report to see specific index growth and analysis which is available to IHEA member companies. For membership information, and a full copy of the 12-page report, contact Anne Goyer, executive director of the Industrial Heating Equipment Association (IHEA). Email Anne by clicking here.