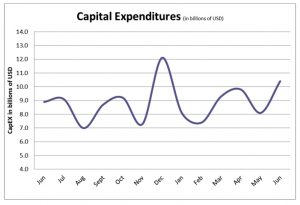

"That sense of euphoria over the rapid growth sustained since the start of the year has started to fade and not for the reason that was expected," states July's Industrial Heating Equipment Association’s (IHEA) Executive Economic Summary. Remember at the beginning of the year, there was an expectation that there would be growth, but it would hopefully be a bit slow. That was preferred because then "producers would be able to keep pace with demand and that would minimize the inflation threat."

The report explains that "What we actually got was an economy on fire with a 6.5% growth rate in Q2. Suddenly the inflation threat was real as producers were quickly overwhelmed." But, as everyone was preparing for growth, Covid reared its ugly head again. "Now we see potential decline in the last half of the year as those protocols and restrictions reappear. "Will there be another lockdown? Will consumers retreat again and send the service sector back into recession?" Those are vital questions that are begging for answers.

Businesses had two possible responses to the early surge, both based on consumer action: add capacity to meet the demand and trust the surge will continue or hold tight and possibly lose business to competitors. The summary reports, "Until roughly a month ago, it would have been a good bet to assume that demand would continue to grow – all the signs and indicators were pointing that way. Today the story is far less clear. The resumption of pandemic protocols has been an immense disappointment and has created significant tension."

So, where does that leave the U.S. economy for the remainder of the year? There are three scenarios: the good, the bad, and the ugly. The good is one in which "people basically adjust to the protocols with some patience. . . . If that is the case, the expectation is that growth rates will be relatively unaffected." The bad suggests that "consumers do not adapt well and begin to shift their behaviors back to what they were last year – shunning events, restaurants, travel, and other public activity." And the ugly scenario could result if "the outbreak gets bad enough that lockdowns are reimposed."

The report concludes that "consumer growth and tension are not good companions." Time will reveal the consumer's chosen scenario.

Check out the full report to see specific index growth and analysis, which is available to IHEA member companies. For membership information, and a full copy of the 12-page report, contact Anne Goyer, executive director of the Industrial Heating Equipment Association (IHEA). Email Anne by clicking here.