The monthly Industrial Heating Equipment Association (IHEA) Executive Economic Summary released in December gives forecasts for Q4 results and takes a look into the start of 2023. The 3.9% growth from Q3 is not expected to be matched in Q4, but the spending power of the consumer holds out hope for battling recession.

The 3.9% growth from Q3 is not expected to be matched in Q4 and beyond, but the spending power of the consumer holds out hope for battling recession. The thought is that inflation highs have peaked, and interest rates could lower about halfway into 2023. Heat treaters should note that applicable indices are remaining steady while still dealing with supply chain problems and work force shortages. Of the 10 economic indices in this report, 6 sectors are steady or seeing growth; while 4 are on a downturn.

Source: IHEA

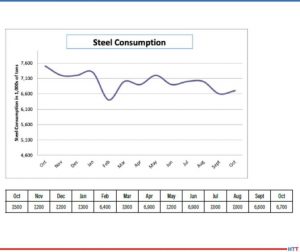

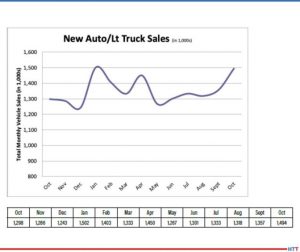

The categories included in seeing maintenance and growth are: New Auto & Light Truck Sales, Steel Consumption, Industrial Capacity Utilization, Metal Pricing, Durable Goods, and Factory Orders. Automotive sales are strong; people are wanting and needing to replace vehicles they've maintained for a long time. "People want new and they are confident enough in their job security to buy a new vehicle."

Source: IHEA

There are no surprises from the Steel Consumption reports, as the "big three sectors are all performing about as expected – vehicle manufacturing, construction and the oil and gas arena." Metal Pricing is seeing a A Tale of Two Cities because copper is affected by political tensions around the world, but aluminum is seeing strong demand, particularly for the aerospace industry.

Source: IHEA

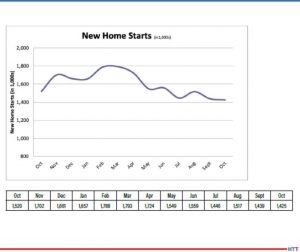

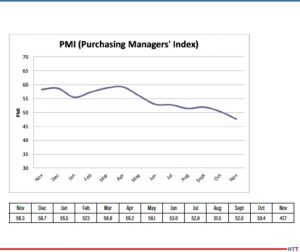

Those indices that are in decline or experiencing drops are: New Home Starts, Purchasing Managers Index (PMI), Capital Expenditures, and Transportation Activity. New home purchases are difficult for those buyers because the interest rates are high. There is a bit of a bright spot for heat treaters since multi-family home sales are still strong; this means metal products are needed - appliances, window frames, and construction components.

Source: IHEA

The PMI "is always a good indicator of overall industrial activity as the purchasing manager will be doing what they do at the start of any industrial process." In the report it's down to 47.7; not an emergency, but very uncomfortable level.

The report on these indices takes a middle-of-the-road approach. There are no alarmingly sharp drop-offs in the reports, neither is there any drastic growth into the positive numbers; it all comes down to inflation. Economic markers are such that the interest rates are as high as they will get indicate a drop about halfway through the new year. The report looks for some lowering of the numbers to "between 4.25% and 4.50%" while the Fed members think the rate "may top out at 5.1%."

Check out the full report to see specific index growth and analysis which is available to IHEA member companies. For membership information, and a full copy of the 11-page report, contact Anne Goyer, executive director of the Industrial Heating Equipment Association (IHEA). Email Anne by clicking here.

Search for heat treat solution providers and suppliers on Heat Treat Buyers Guide.com