Heat Treat Economic Indicators: September 2024 Results

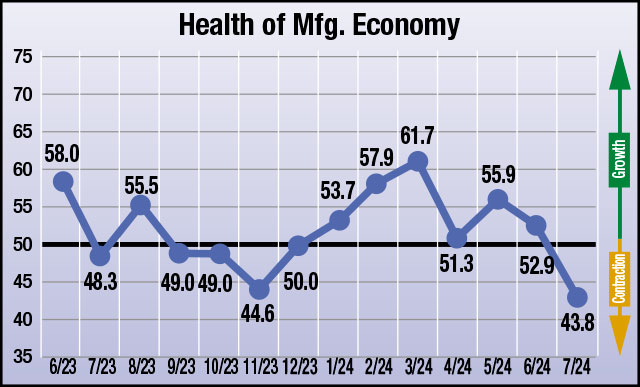

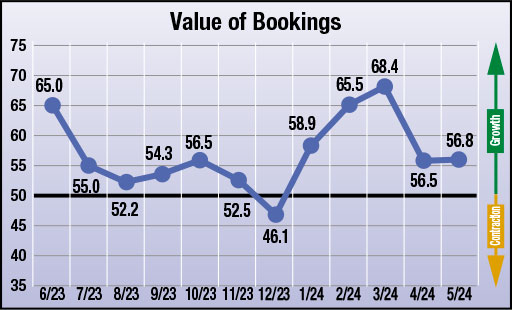

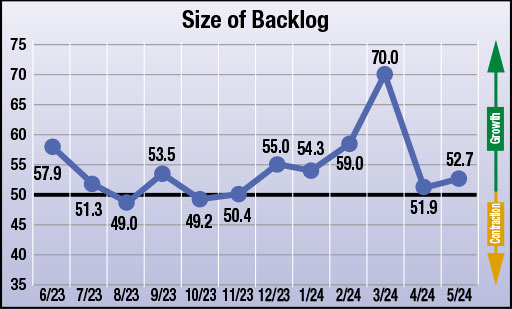

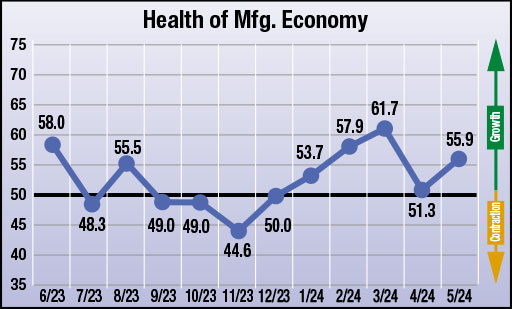

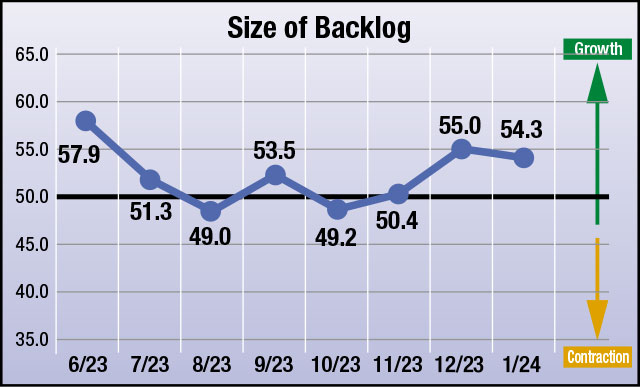

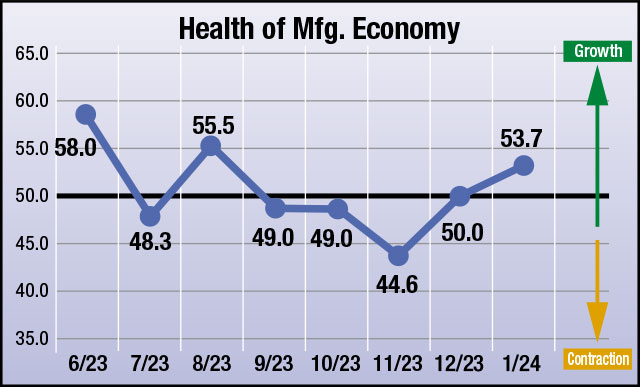

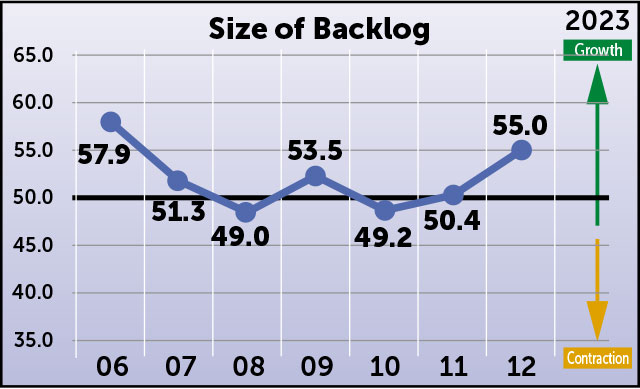

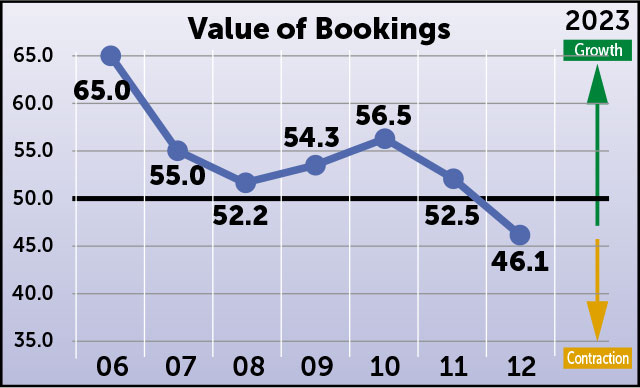

The four heat treat industry-specific economic indicators have been gathered by Heat Treat Today each month since June 2023. Last month, suppliers had anticipated most indicators to grow. This month, the four economic indicators are split between anticipated growth and no change or contraction.

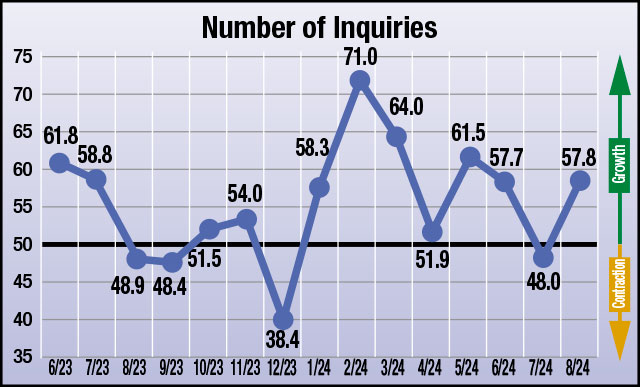

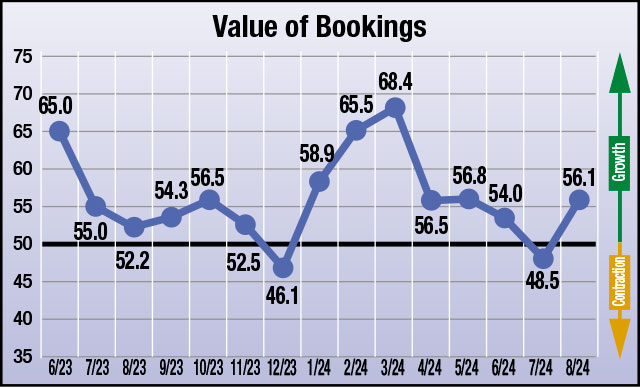

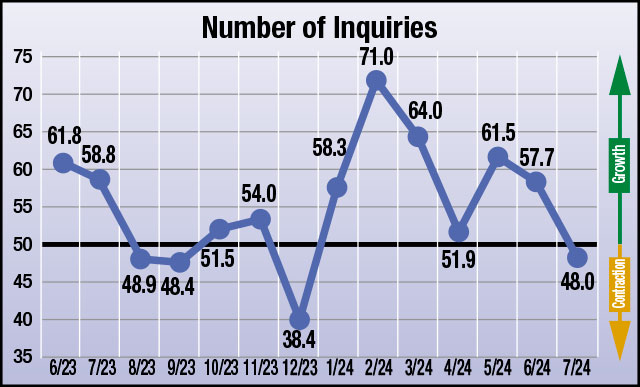

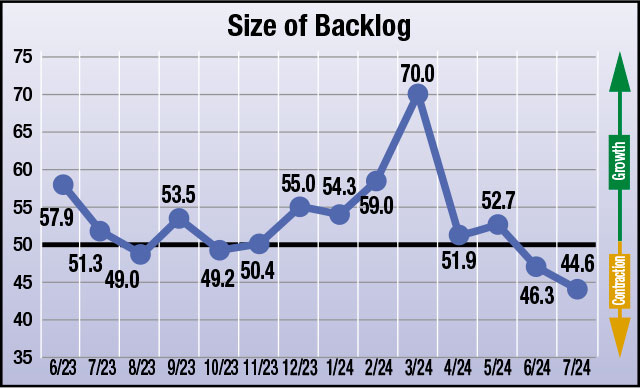

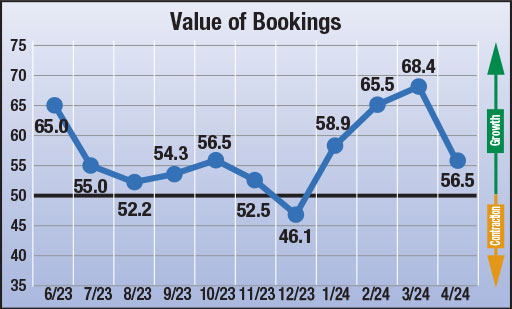

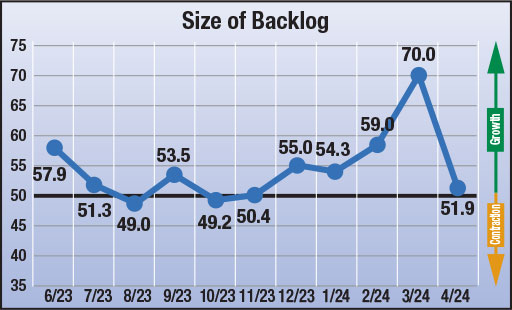

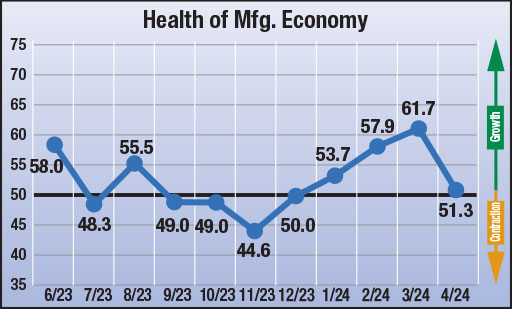

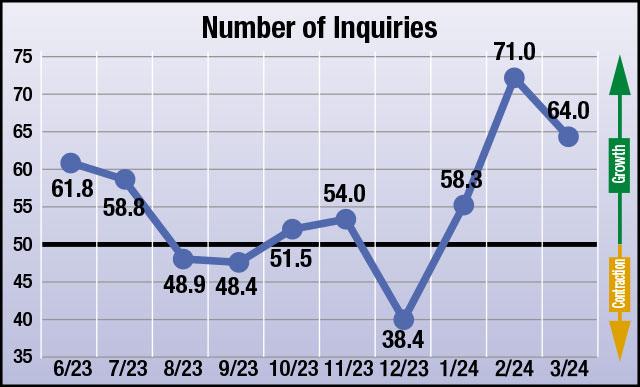

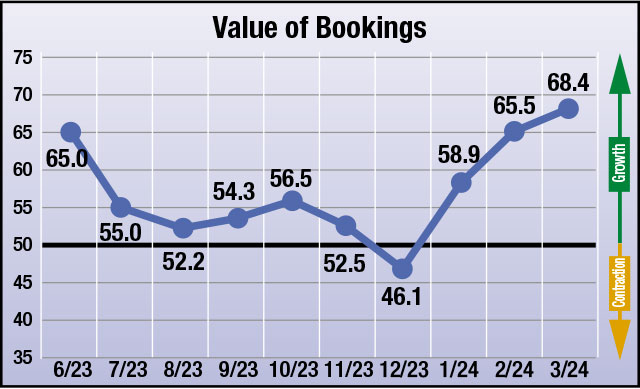

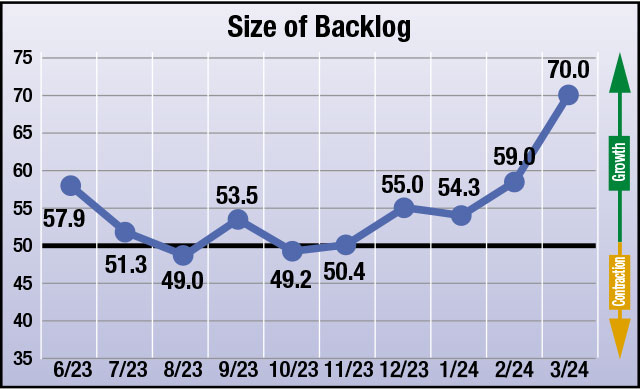

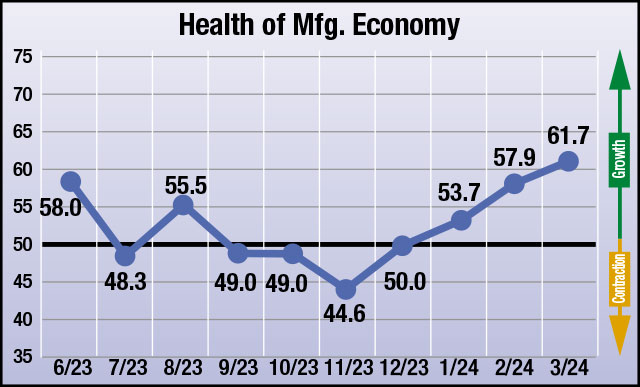

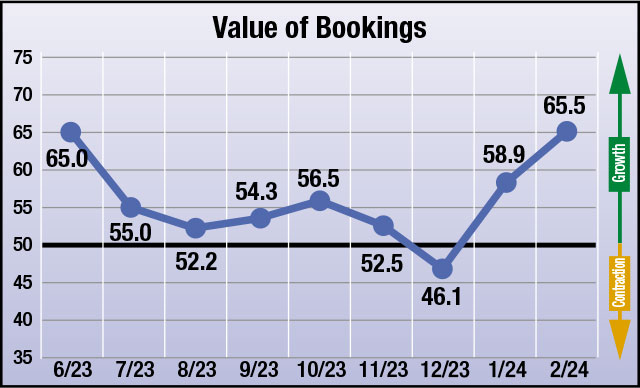

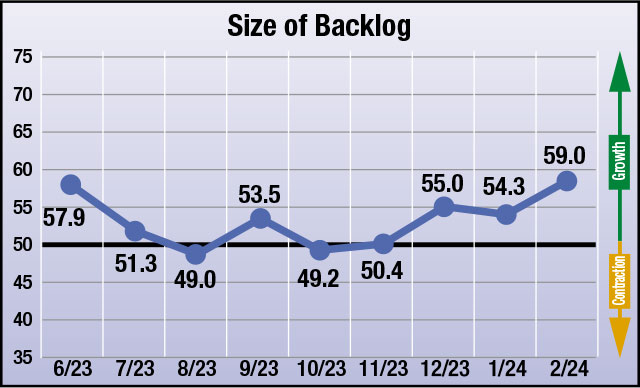

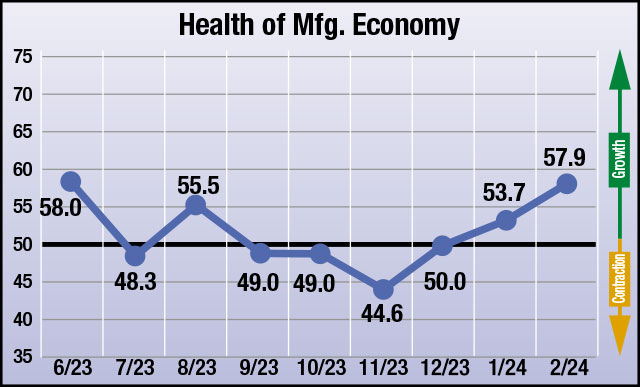

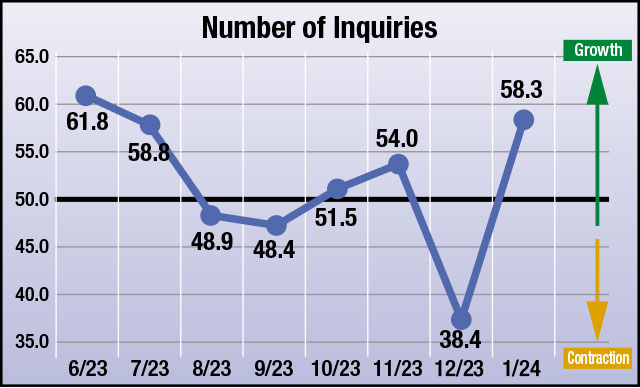

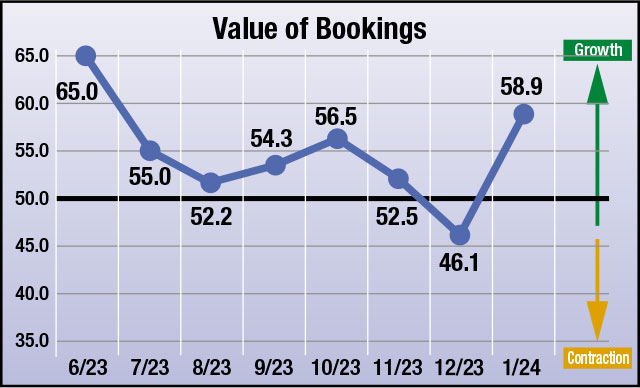

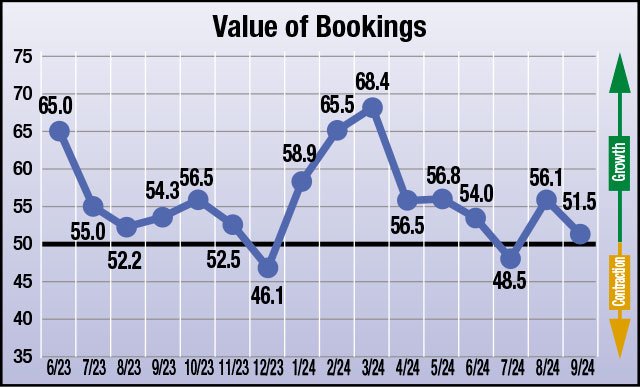

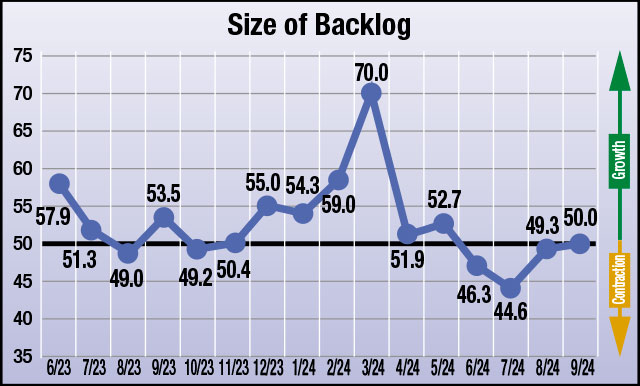

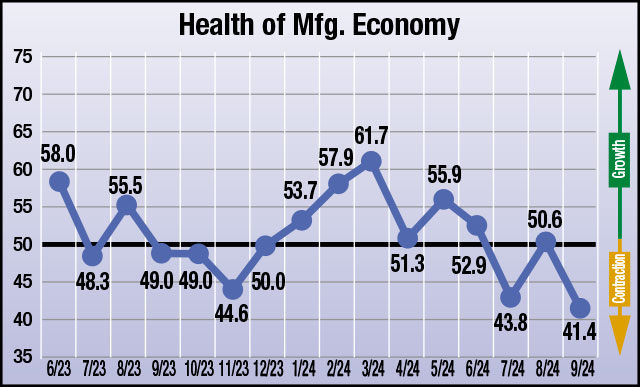

The numbers, which were compiled in the first week of September, show that responding parties expect the economy to experience growth in two of the four indices, in the number of inquiries and value of bookings. Anticipation for growth in backlog size is neutral, and suppliers anticipate contraction in health of the manufacturing economy.

The results from this month’s survey (September) are as follows; numbers above 50 indicate growth, numbers below 50 indicate contraction, and the number 50 indicates no change:

- Anticipated change in Number of Inquiries from August to September: 54.0

- Anticipated change in Value of Bookings from August to September: 51.5

- Anticipated change in Backlog Size from August to September: 50.0

- Anticipated change in Health of the Manufacturing Economy from August to September: 41.4

Data for September 2024

The four index numbers are reported monthly by Heat Treat Today and made available on the website.

Heat Treat Today’s Economic Indicators measure and report on four heat treat industry indices. Each month, approximately 800 individuals who classify themselves as suppliers to the North American heat treat industry receive the survey. Above are the results. Data started being collected in June 2023. If you would like to participate in the monthly survey, please click here to subscribe.

Find heat treating products and services when you search on Heat Treat Buyers Guide.com

Heat Treat Economic Indicators: September 2024 Results Read More »