Heat Treat Economic Indicators for February: Broad Stability

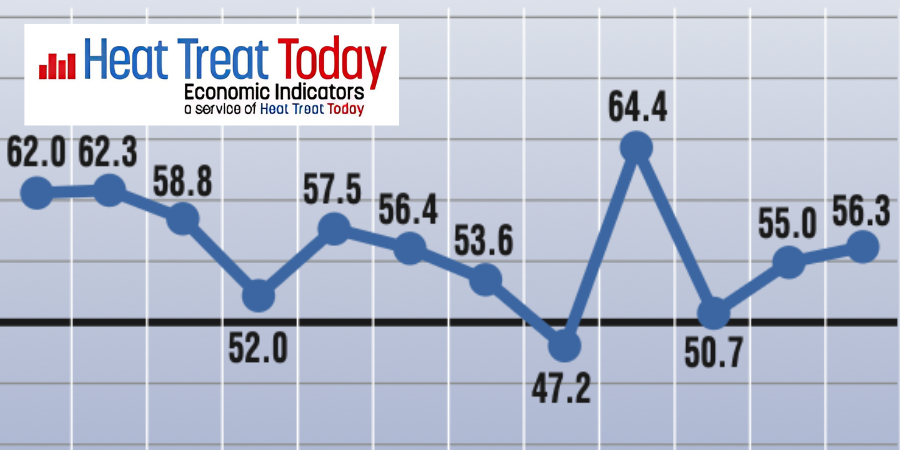

Heat Treat Today has gathered the four heat treat industry-specific economic indicators for February 2026. The February results show building momentum compared to the January 2026 predictions.

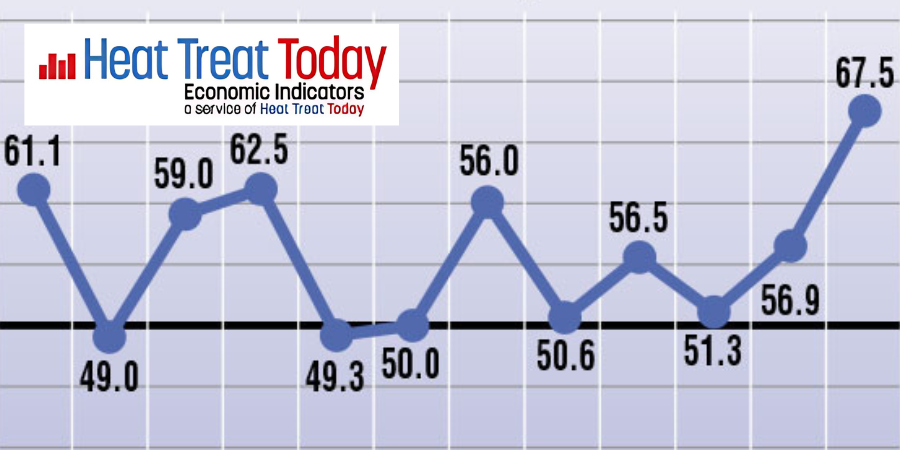

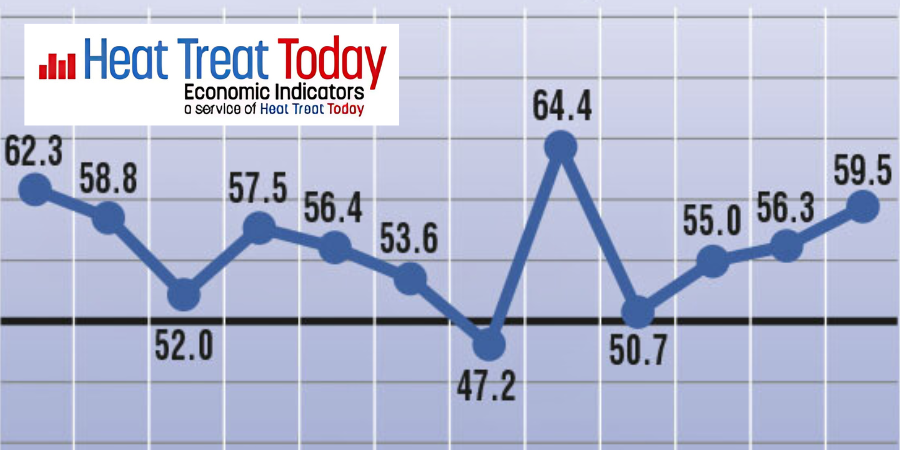

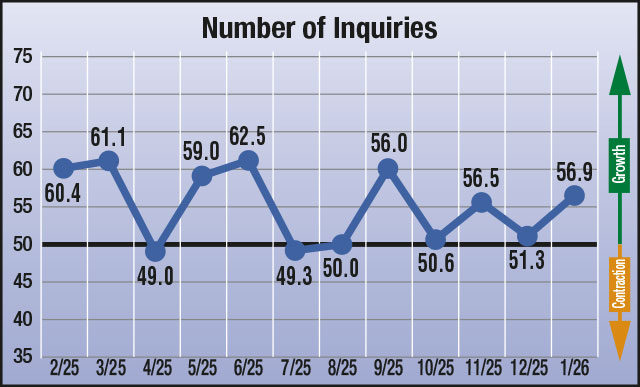

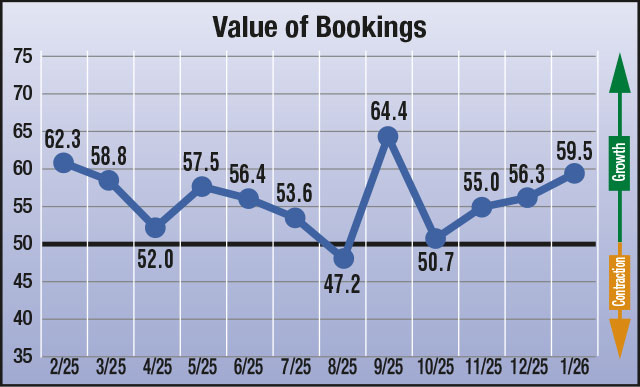

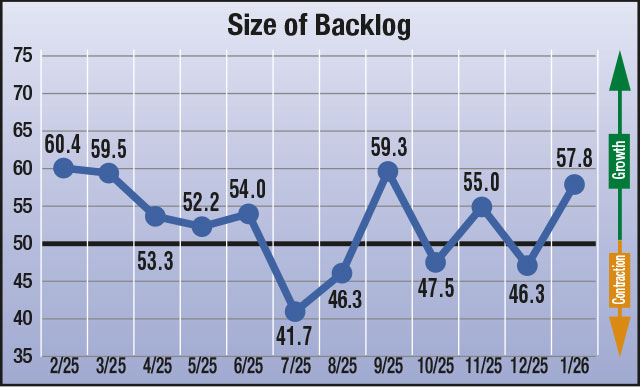

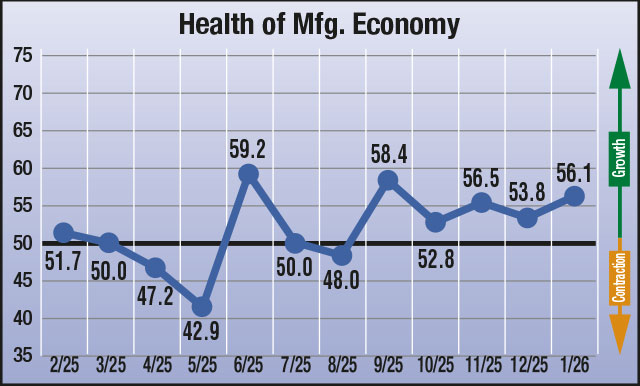

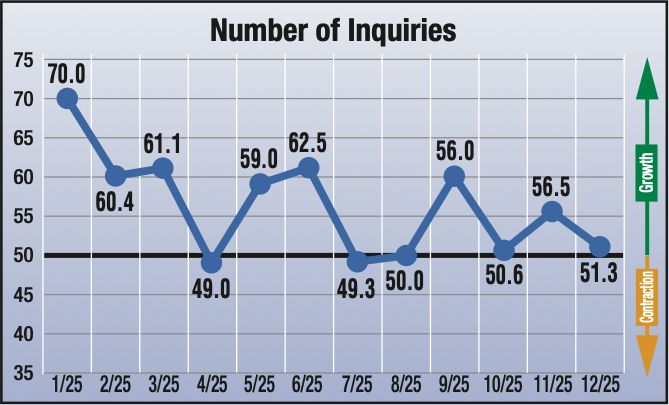

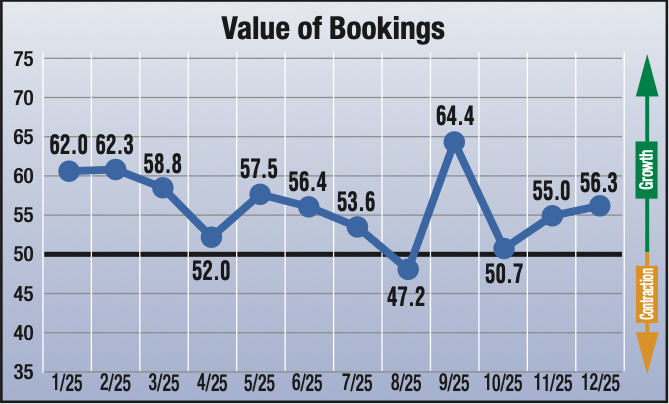

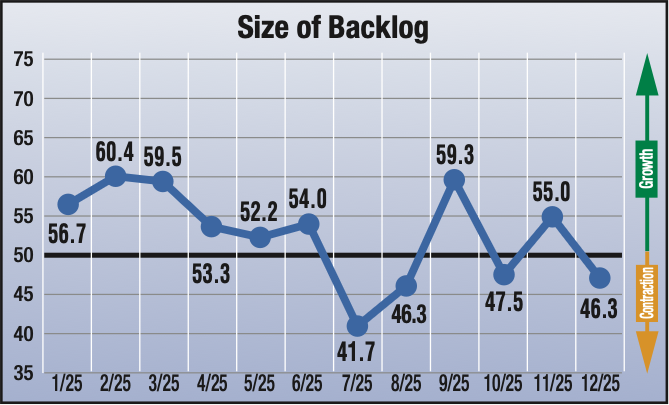

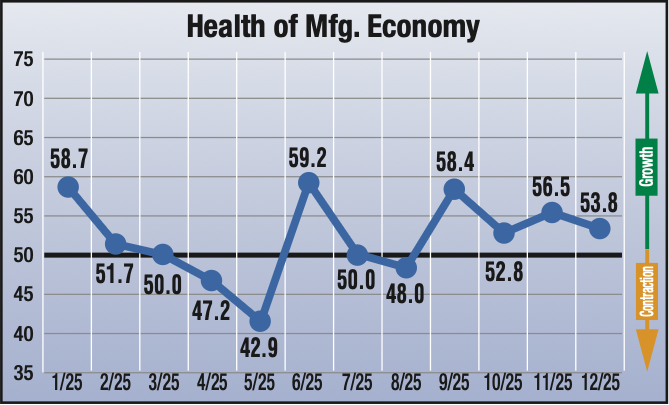

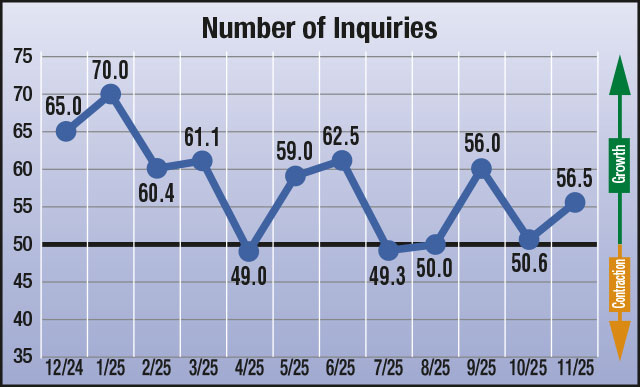

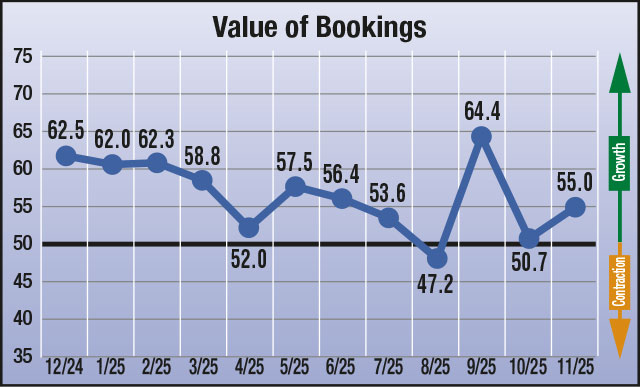

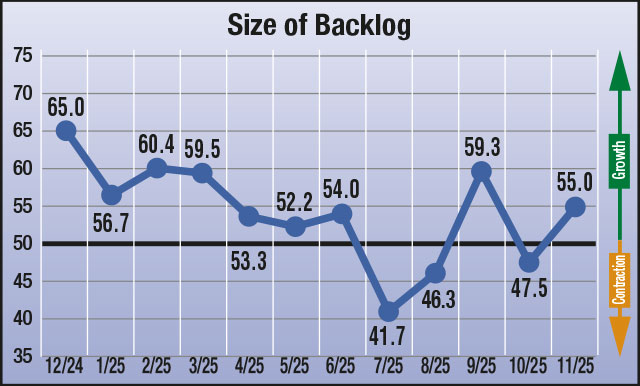

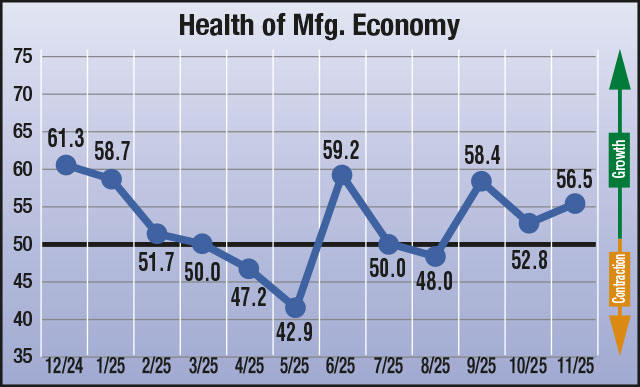

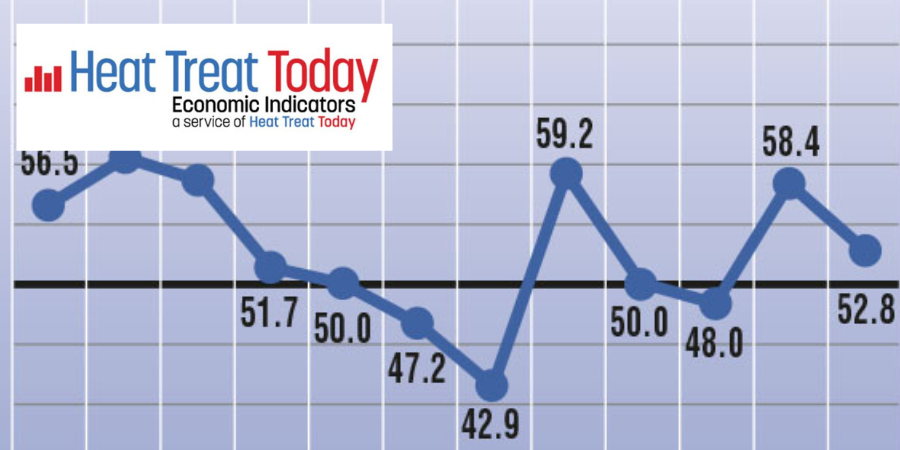

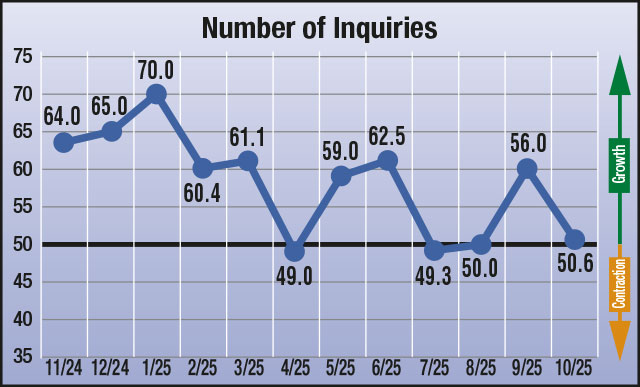

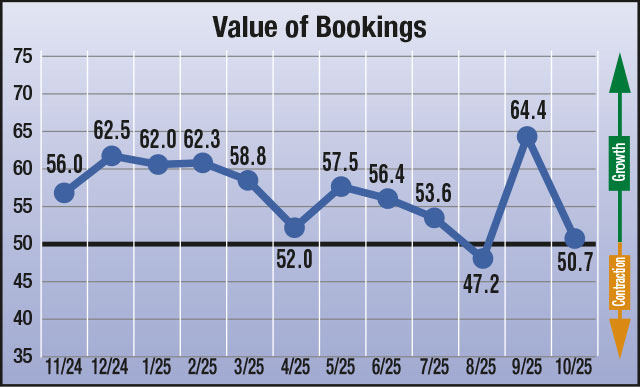

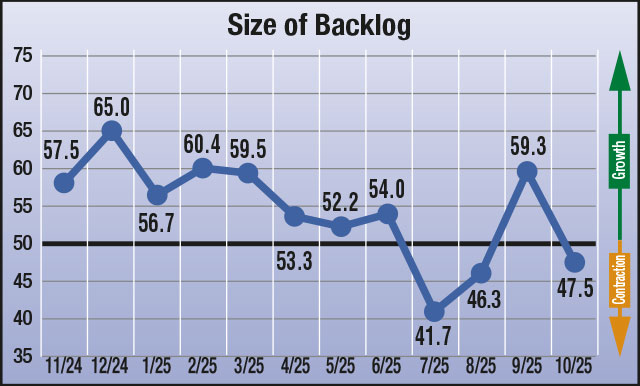

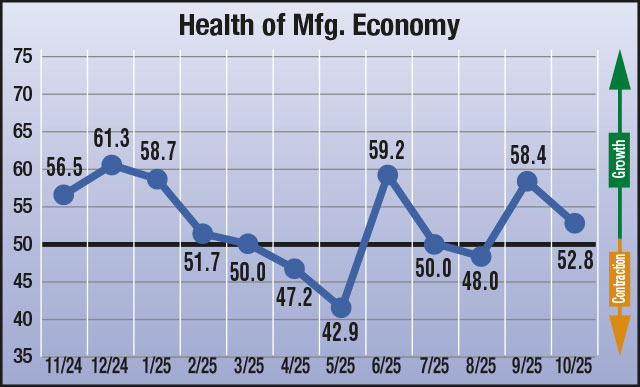

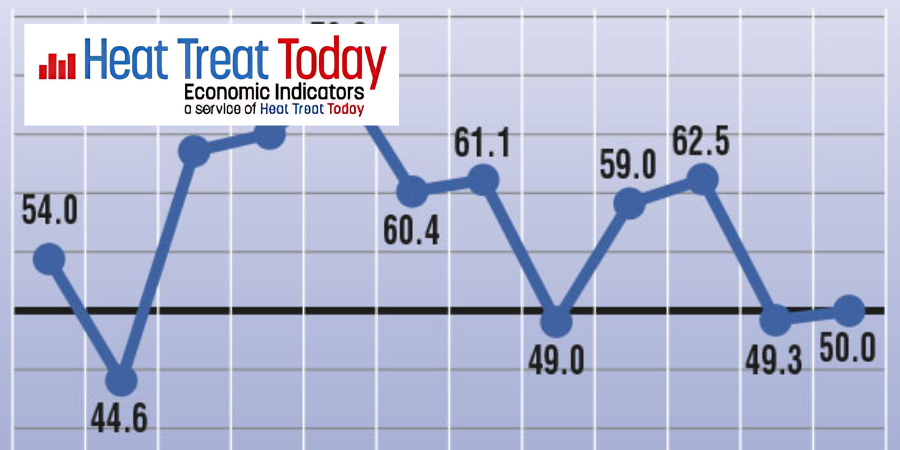

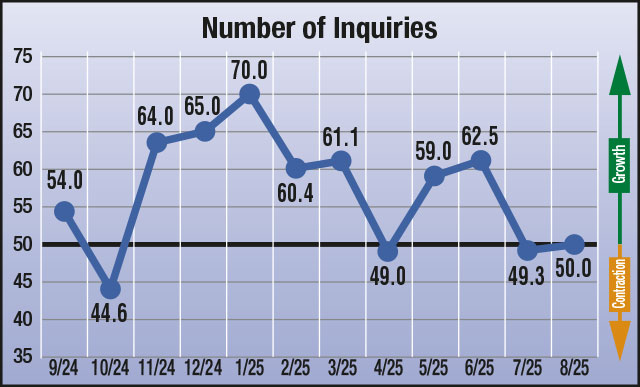

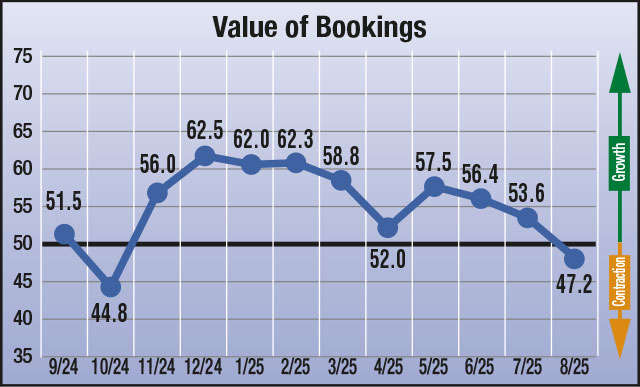

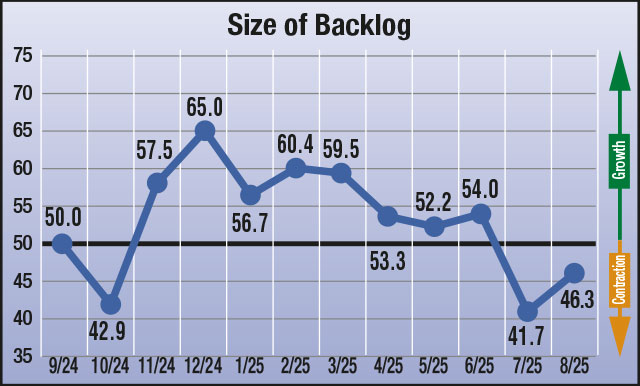

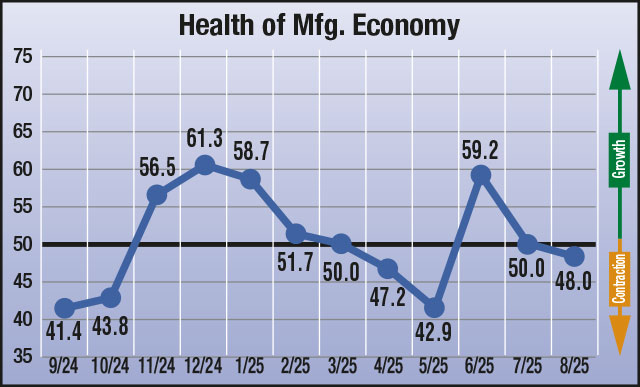

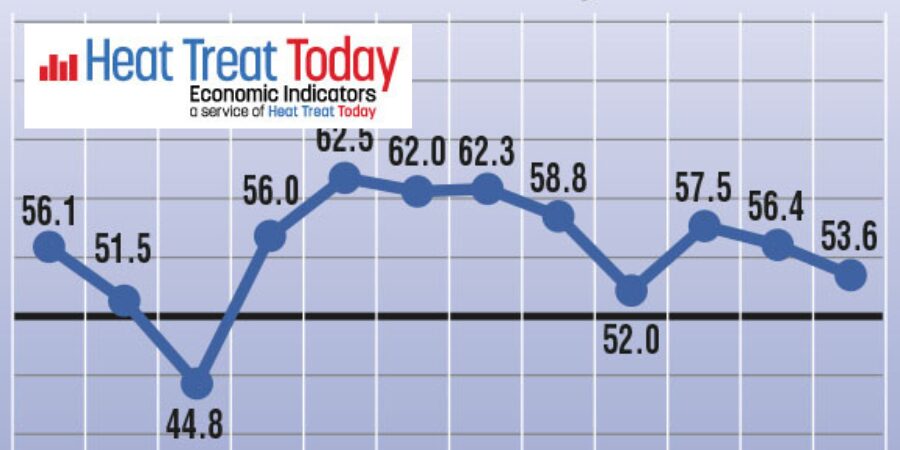

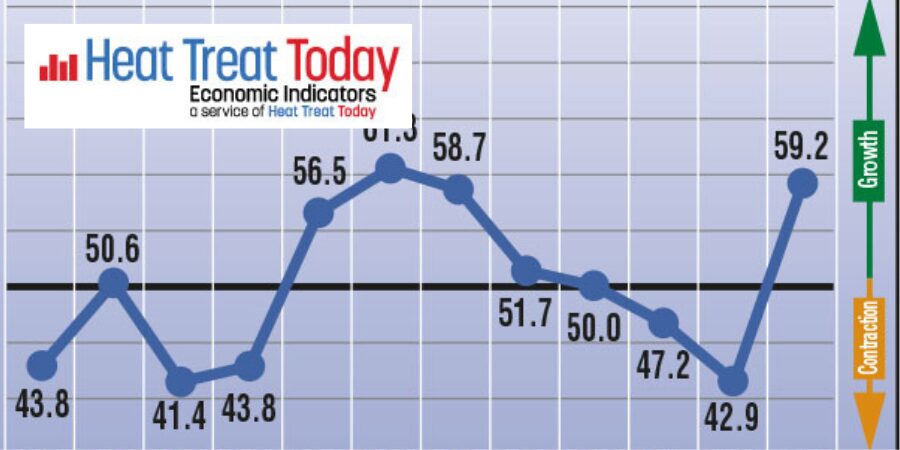

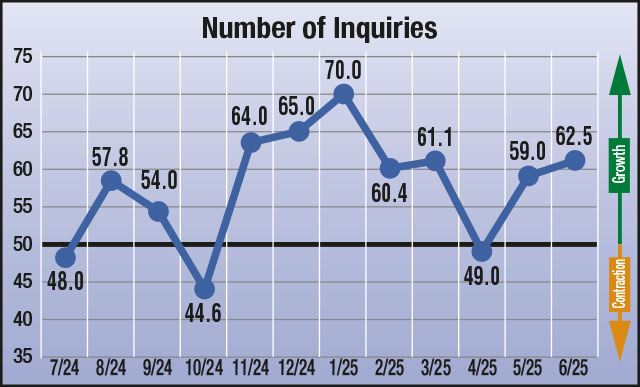

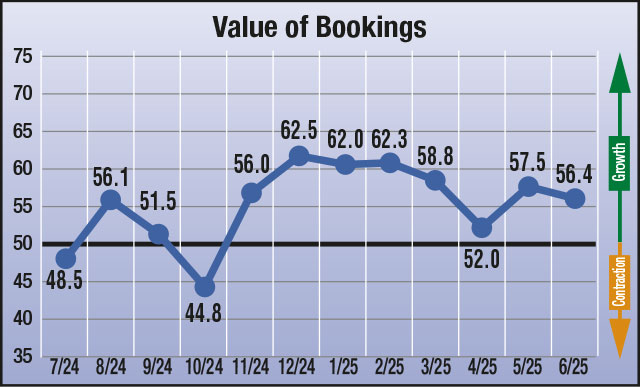

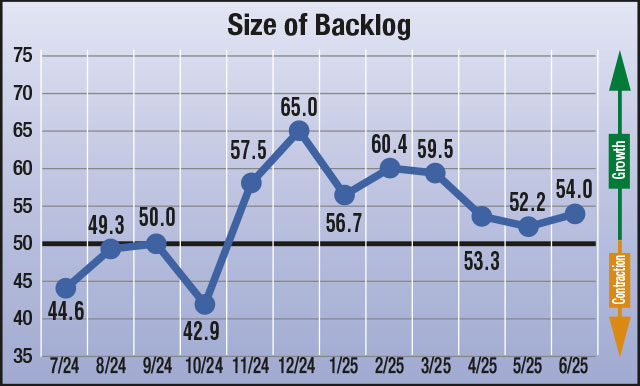

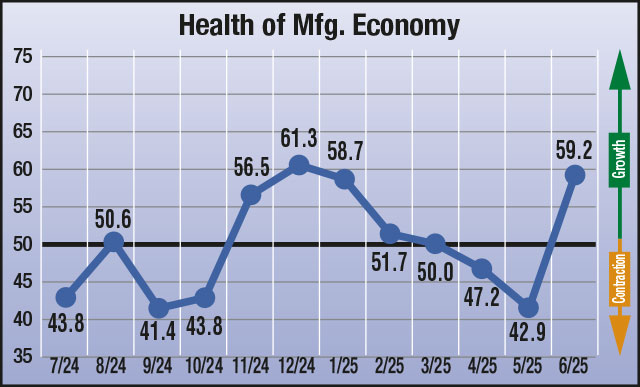

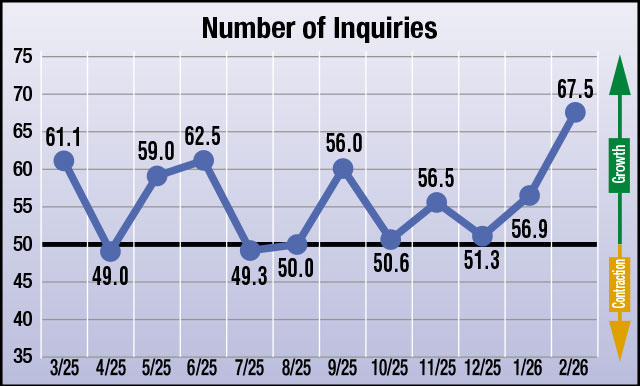

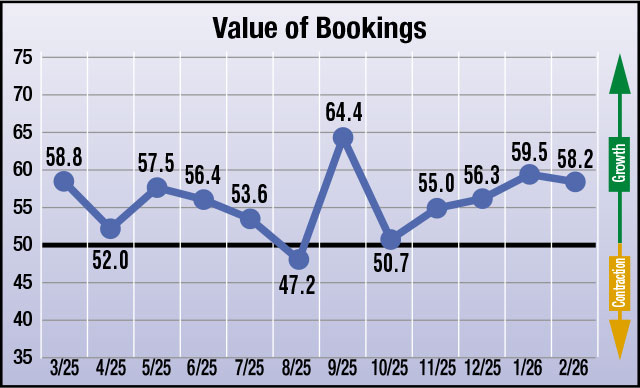

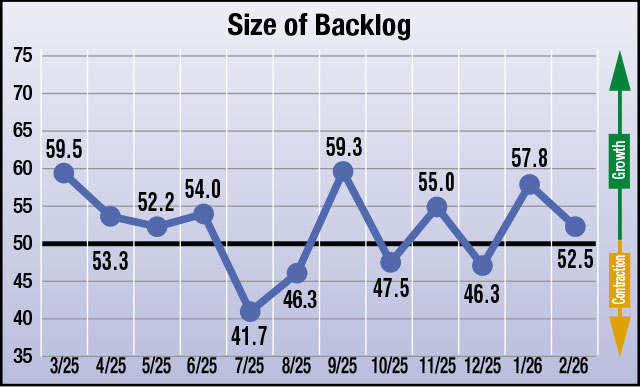

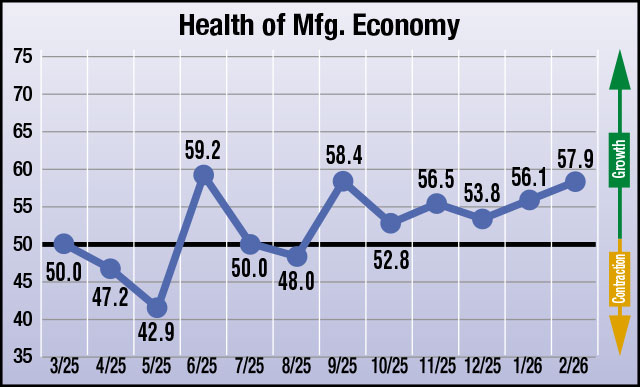

February’s data points to a steady manufacturing environment, as all four indices remain above the growth threshold, driven by a notable jump in expectations for growth in the Number of Inquiries at 67.5 (up from 56.9 in January). Bookings stayed firmly in growth territory, reflecting stable demand at 58.2 (from 59.5 in January). The Backlog index showed modest softening but remained neutral, indicating balance rather than decline at 52.5 (from 57.8 in January). Finally, the Health of the Manufacturing Economy index continued its upward trend at 57.9 (up from 56.1 in January).

February’s indicators reinforce a theme of stability with underlying momentum. While month-to-month fluctuations remain, the overall picture points to resilience and selective strengthening as the industry moves deeper into the first quarter.

The results from this month’s survey (February) are as follows: numbers above 50 indicate growth, numbers below 50 indicate contraction, and the number 50 indicates no change:

- Anticipated change in Number of Inquiries from January to February: 67.5

- Anticipated change in Value of Bookings from January to February: 58.2

- Anticipated change in Size of Backlog from January to February: 52.5

- Anticipated change in Health of the Manufacturing Economy from January to February: 57.9

Data for February 2026

The four index numbers are reported monthly by Heat Treat Today and made available on the website.

Heat Treat Today’s Economic Indicators measure and report on four heat treat industry indices. Each month, approximately 800 individuals who classify themselves as suppliers to the North American heat treat industry receive the survey. Above are the results. Data collection began in June 2023. If you would like to participate in the monthly survey, please click here to subscribe.

Heat Treat Economic Indicators for February: Broad Stability Read More »