The monthly Industrial Heating Equipment Association (IHEA) Executive Economic Summary released in June provides some bad news and some good news about the U.S. economy status. Referring to the Leading Economic Indicators, the nation is in one of the lowest spots it has been for 23 years. A silver lining: This low point is not as low as other drops (2000-2001, 2007-2009, and 2020).

While this certainly shows the nation in a difficult spot, the report continues with some encouraging news. Even better, the heat treat industry can find positive impacts with the U.S. continuing to increase reshoring efforts as well as labor shortages helping with job security and job availability for industry workers.

The economic indices demonstrate that "[t]he majority of the data . . . shows solid performance and even the declines are relatively minor." There are drops in these sectors: Steel Consumption, Metal Pricing, Purchase Managers Index, Capital Expenditures, and Transportation Activity. Five indices show increase or at least holding steady: New Home Starts, Industrial Capacity Utilization, New Auto & Light Truck Sales, Durable Goods, and Factory Orders.

In New Auto and Light Truck Sales, the numbers are looking good. The report indicates this comes as a surprise, but it's good news for those manufacturing new vehicles.

Source: IHEA

The Steel Consumption index shows lots of ups and downs. Certainly there are still some supply chain issues, and the demand for construction of office space has been low during/since the pandemic. Growth stems from the reshoring movement as well as in construction for manufacturing facilities.

Source: IHEA

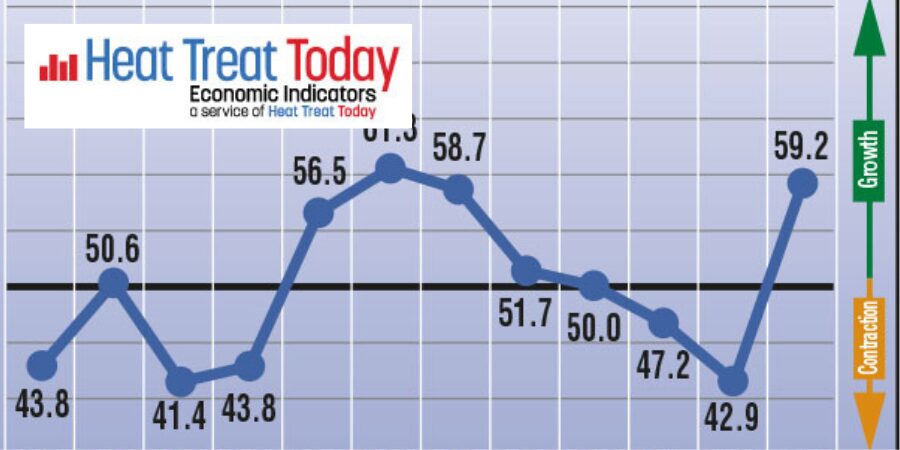

The Purchasing Managers' Index measures industrial purchases for manufacturers. The PMI is going to drop if the purchase managers feel that the economy is slowing. Raw materials and other purchases are slowing down here, as the data shows.

Source: IHEA

Conversely, Durable Goods is staying strong. Vehicles, appliances, even electronics are selling. Putting the PMI and this Durable Goods data together shows the two sides of the coin very clearly. Maybe the nation is just in economic slowdown, not entering dangerous recession.

Source: IHEA

IHEA's report points out, "the U.S. is a country so large and diverse that it can easily host both recession and growth." With the majority of the indices holding steady or, at worst, seeing minimal drops, the coin toss of economic future doesn't seem too extreme in either positive or negative directions.

Check out the full report to see specific index growth and analysis which is available to IHEA member companies. For membership information, and a full copy of the 11-page report, contact Anne Goyer, executive director of IHEA. Email Anne by clicking here.

Find heat treating products and services when you search on Heat Treat Buyers Guide.com

Find heat treating products and services when you search on Heat Treat Buyers Guide.com