IHEA Monthly Economic Report: Be Careful What You Wish For

We are living in a volatile and ever-changing world right now— on many fronts. And so, when April's Industrial Heating Equipment Association’s (IHEA) Executive Economic Summary begins, "Be careful what you wish for – you just might get it," it causes one to pause. There have been areas of growth during the early months of 2021, but as the report states, "With growth come the challenges of growth. . ."

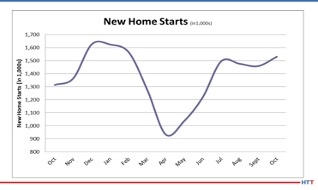

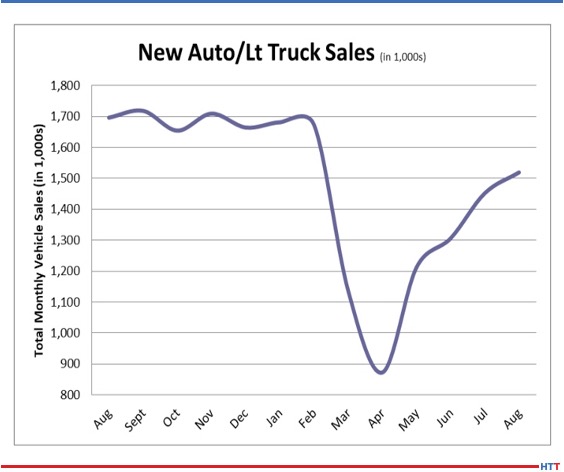

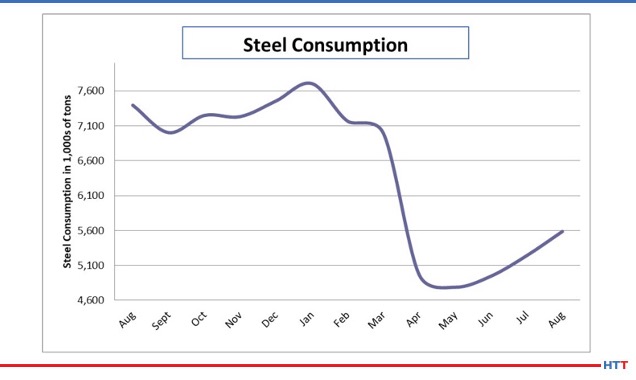

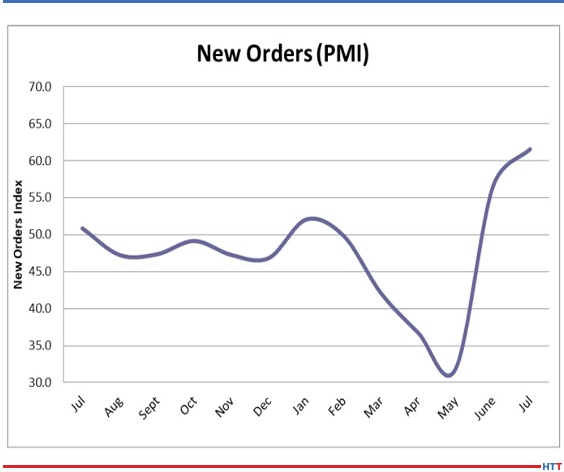

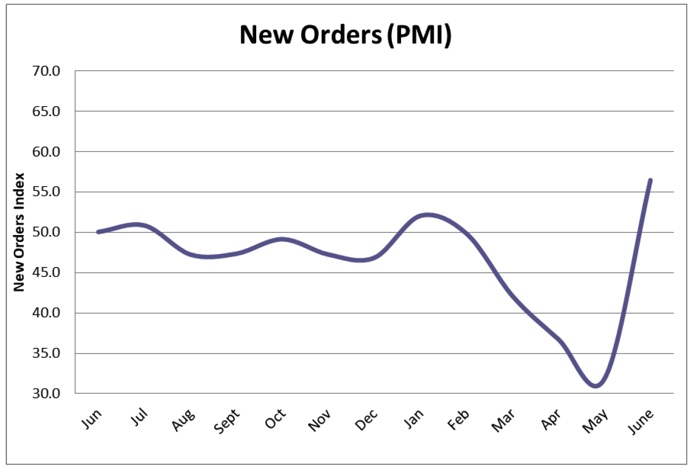

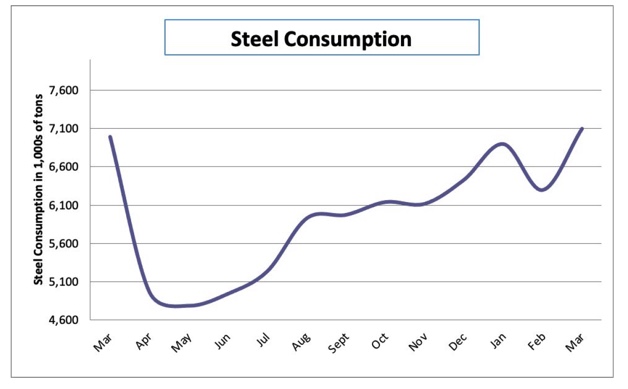

"Everything in this month’s report points to further growth and that is good except when it isn’t," the summary continues. What can challenge economic growth? Inflation and the three planks of inflation are commodity price hikes, wage hikes, and overall increase in money supply. Because of the growth, "the inflation threats are here to stay for a while." While the time frame isn't known, the two drivers that will contribute to its longevity or brevity are demand and supply. The report explains, "The demand side is pushing inflation for the moment – there is too much for the producers to keep pace with. The suppliers were not ready for this level of demand and remain a little cautious as far as how long that demand holds." It appears that the demand is real and that production will ramp up to meet the demand.

The one potential sticky point may be the money supply driver for inflation mentioned earlier. The economic report continues, "In normal circumstances there is a limit to inflation tolerance that stems from the willingness and ability to pay the higher prices." So, either the consumer has the means to pay the higher price or he deems it too high and will forgo the purchase. But today, with "close to $5.5 trillion in excess savings worldwide. . . the consumer will complain about the higher price, but then they will shrug their collective shoulders and pay anyway because they want the good or service offered and they have the money to pay for it. Those that will be left behind will be those that don’t have the money set aside or lack the ability to increase their personal money supply – the fixed income consumer and the company that is locked into their current pricing structure."

The report concludes with the expectation, barring no unexpected crisis, that "inflation pressures will ease by the end of the summer or early fall as the producers catch up with demand. This is the season of hurricanes and storms capable of creating issues that cascade through the markets and there is more fragility in the system than has normally been the case."

Check out the full report to see specific index growth and analysis which is available to IHEA member companies. For membership information, and a full copy of the 12-page report, contact Anne Goyer, executive director of the Industrial Heating Equipment Association (IHEA). Email Anne by clicking here.

IHEA Monthly Economic Report: Be Careful What You Wish For Read More »